AscensionPoint Recovery Services is a BBB accredited business. However, its online reputation doesn’t seem to be all that well. So, if AscensionPoint Recovery Services is harassing you, then you can use the F.D.C.P.A. for your protection. Here’s how.

It is better to avoid taking loans and owing debts, as this is naturally how most want to operate. However, economic conditions fluctuate, and you can end up finding yourself in economic hardship.

This is where debt collection agencies come into play. They are required to collect debts from you, by hook or by crook. And this is where it all gets shady.

Even though the “by hook or by crook” strategy is not ideal by any stretch of the imagination and nor it’s appreciated by the law. Still, some debt collection companies tend to go for it.

There are many who have suffered because of the Debt Collection Agencies’ ruthless behavior and incomplete investigation. And if you happen to be among those, then keep reading. We have a lot to tell you about what U.S. federal law has to say on the matter.

U.S. federal law protects you from the harassment, abuse, and other vicious tactics employed by debt collection agencies in order to collect debts.

AscensionPoint Recovery Services Online Reputation

AscensionPoint Recovery Services is a Better Business Bureau Accredited Business. In this regard, AscensionPoint has a competitive edge over its previously discussed counterparts. Plus, it has been in the business for 14 years.

However, in the last three years particularly, there have been only 5 complaints against AscensionPoint Recovery Services and only 11 of those were concerning a problem with a product or service whereas 39 of those complaints were regarding billing and collections.

Now, 17 complaints were closed in the last 12 months and only 11 of the remaining ones have been resolved by the company. However, the best part is that there are no complaints that are left unresolved. The company made sure to answer each of them online. That’s the second competitive edge that’s in addition to its BBB Accreditation.

Now, before we move on towards further discussing the online reputation of the company, please consider taking a look at some snapshots down below…

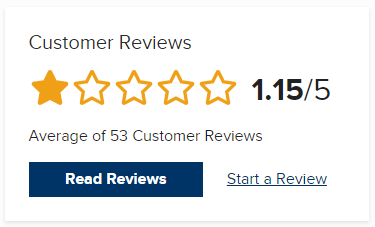

Despite trying its best to resolve customer complaints, AscensionPoint Services ended up receiving pretty low ratings online. For the most part, people don’t seem to be happy about the whole service. There are only 68 reviews, all with pretty much the same opinion.

The ratings are no different for AscensionPoint Services when you take a look at the Better Business Bureau’s profile of the company.

Are You Being Harassed By AscensionPoint Recovery Services?

It is a sad thing to know, however, it’s a reality that harassment has somehow become a part of debt collection. Ideally, it shouldn’t have been the case, seeing as the law doesn’t appreciate it.

However, if debt collection agencies are harassing you, then they are held responsible by the law. And that’s the bottom line.

By threatening and verbally abusing you, you can use their abuse to counter them by suing their company for abuse.

How F.D.C.P.A. Protects You

If you want to know your rights in detail, consider reading the act completely. We are just going to discuss three important aspects that answer the actual concerns of many.

You can cease all the communication with the debt collection agency, you can redirect them towards your attorney and not get to contact them at all, and you get to enjoy the consumer’s time zone.

1. Consumer’s Time Zone

F.D.C.P.A. or Fair Debt Collection Practices Act is a representation of respect that a customer is liable to under the law. The act makes mention of “consumer’s time zone”. Generally, the consumer’s time zone is before 8:00 am or after 9:00 pm.

In addition to that, such places are added to the consumer’s time zone where it is inconvenient for the customer to place a call. Calls by the debt collection agency at these places and times can only be made if and only if the consumer or the court of competent jurisdiction has allowed.

2. No Contacts With The Customer

If the debt collector knows that the customer has hired an attorney and the customer can easily be sure of the attorney’s name and address, then the collection agency is not allowed to make any contact with the customer unless the attorney becomes unresponsive or allows to have direct contact with the customer.

So, if you don’t want to get contacted, hire an attorney right away. We at Haseeb Legals LLC can help you enjoy this freedom. Just go about your day without any fear of getting contacted by your debt collection agency and facing harassment.

3. Ceasing Communications With The Customer

F.D.C.P.A. orders all further communications to be ceased if a consumer requests validation. However, note that a validation request should be in writing.

These are some of your rights under the Fair Debt Collection Practices Act. However, the act is not just limited to what we discussed. Stay tuned to our blog posts if you want to learn more about them or click here.

Before You Go

Just before you go, there are a few but important takeaways for you. First and foremost, never allow any underestimation during your contact with the debt collection agency.

Whether it’s through the call, e-mail, or mail. Stay vigilant and reasonably respond to any aggressive behavior without any delays. This closes the door for further abuse during the contact.

However, if the agency harasses you, don’t worry. Instead of falling under pressure, stay relaxed. That’s because the debt collection service’s unprofessional behavior has given you the upper hand when it comes to the Fair Debt Collection Practices Act.

Hire an attorney, pursue the case, and cease the communication with the debt collection agency immediately.

If you are looking for someone who can help you out, contact Haseeb Legal LLC right away. We can help you use the law to press your claim.